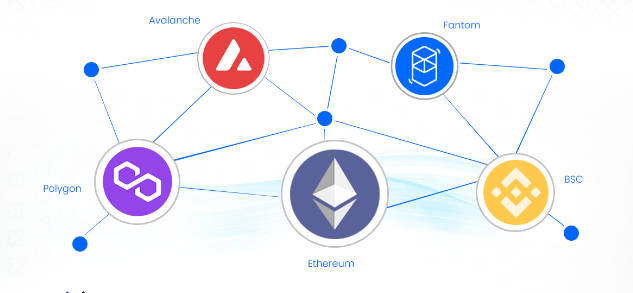

The blockchain landscape has evolved dramatically since the inception of Bitcoin in 2009. What began as a single, revolutionary distributed ledger has blossomed into a diverse ecosystem of blockchain networks, each with its unique features, strengths, and limitations. As the number of blockchain platforms continues to grow, so does the need for interoperability between these disparate systems. This is where cross-chain technology comes into play, serving as the crucial bridges that connect these isolated blockchain islands into a cohesive, interoperable network.

In this comprehensive exploration, we’ll delve deep into the world of cross-chain technology, examining its critical role in the future of decentralized finance (DeFi) and the broader Web3 ecosystem. We’ll uncover the myriad benefits of cross-chain solutions, confront the challenges they face, and introduce Xythum, an innovative cross-chain bridge that’s pushing the boundaries of what’s possible in this exciting field.

Why Cross-Chain Technology is Important

The blockchain world is currently divided into two primary architectural paradigms: monolithic and modular. Monolithic blockchains, like Bitcoin and Ethereum, attempt to handle all aspects of blockchain functionality - consensus, data availability, and execution - on a single layer. Modular blockchains, on the other hand, separate these functions across different layers, potentially improving scalability and efficiency. Examples of Modular blockchains could be Polkadot (Allows anyone to create interoperable parathreads of single blockchain), COSMOS and Avalanche. Well as a matter of fact Eth2.0 has become more layer2 friendly where in it is scalaled by its layer2s.

However, the true vision of Web3 - a decentralized, user-centric internet - cannot be fully realized by either approach alone. Web3 is not about isolated blockchain silos, whether monolithic or modular. It’s about creating a seamless, interconnected ecosystem where assets, data, and functionality can flow freely between different blockchain networks. This is the promise of cross-chain technology.

Let’s explore the key areas where cross-chain technology is making a significant impact:

Asset and Context Transfer

One of the most immediate and tangible benefits of cross-chain technology is the ability to transfer assets and context(data or state) between different blockchain networks. This capability has far-reaching implications for the DeFi ecosystem and beyond:

Liquidity Flow Between Chains

Cross-chain asset transfer allows for the free flow of liquidity between different blockchain networks. This is particularly beneficial for smaller, newer chains that might struggle to attract liquidity. By connecting to larger, more established chains through cross-chain bridges, these smaller chains can tap into deeper liquidity pools, enhancing their functionality and appeal to users and developers alike. For example, a new layer-2 solution built on Ethereum could use cross-chain technology to access the vast liquidity available on the Ethereum mainnet. This would allow the layer-2 solution to offer more competitive rates and a better user experience, even in its early stages.

Unified Liquidity Access

Imagine a scenario where a user holds a significant amount of ETH on the Ethereum network but wants to participate in a yield farming opportunity on the Binance Smart Chain. Without cross-chain technology, the user would need to go through a centralized exchange, incurring fees and delays. With cross-chain asset transfer, the user could seamlessly move their ETH to the Binance Smart Chain, participate in the yield farming opportunity, and move their assets back to Ethereum when desired.

Cross-chain asset transfer enables users to share assets and maintain diversified portfolios across multiple chains. This not only provides greater flexibility in asset management but also allows for more effective risk distribution.

Cross-chain asset transfer can revolutionize liquidity mining and yield farming strategies. Users can quickly move their assets to whichever chain is offering the best yields at any given time, without being locked into a single ecosystem.

NFT and Token Transfers

Cross-chain technology isn’t limited to fungible tokens. It also enables the transfer of non-fungible tokens (NFTs) and other unique digital assets between chains. This opens up exciting possibilities for interoperable digital art markets, cross-chain gaming experiences, and more.

Interoperable Smart Contracts

Cross-chain messaging protocols allow smart contracts on different chains to communicate with each other. This enables complex, multi-chain workflows and the creation of decentralized applications that leverage the strengths of multiple blockchain networks.

An example of this could be a cross-chain decentralized exchange. The order matching could happen on a high-throughput chain optimized for computation, while the actual settlement of trades occurs on the native chains of the traded assets, all coordinated through cross-chain messaging.An Another use case for interoperable Smart Contracts could be a decentralized insurance platform could use cross-chain smart contracts to assess risk factors stored on one blockchain, trigger payouts based on oracle data from another chain, and execute the actual payment on a third chain optimized for fast, low-cost transactions.

Cross-chain DEXs leveraging interoperable smart contracts can represent a significant leap forward in trading efficiency and liquidity. By allowing users to trade assets across different blockchains without needing to use centralized intermediaries, these platforms can offer deeper liquidity, better prices, and a more seamless trading experience.

SPV Verification Across Chains

Simplified Payment Verification (SPV) is a technique that allows for the verification of transactions without needing to download the entire blockchain. Cross-chain SPV enables the verification of transactions on one chain from another chain. This capability is fundamental to many cross-chain bridges and opens up possibilities for innovative cross-chain applications. For example, a lending platform on Ethereum could use cross-chain SPV to verify collateral held on Bitcoin, allowing users to borrow against their Bitcoin holdings without actually moving those assets to Ethereum.

Cross-Chain Oracles

Oracles play a crucial role in bringing off-chain data onto the blockchain. Cross-chain oracles take this a step further, allowing data from one blockchain to be used in smart contracts on another blockchain. This could enable, for instance, a prediction market on one chain to settle bets based on the outcome of a smart contract execution on another chain, expanding the range of events that can be bet on and potentially increasing the accuracy of predictions.

Identity Sharing

In the current blockchain ecosystem, user identity remains fragmented across multiple platforms and chains. Users often need to create separate accounts on different blockchains, leading to a disjointed and inefficient user experience. Cross-chain identity sharing aims to solve this problem by creating a unified identity layer that spans multiple blockchain networks.

It could potentially solve hurdles of

- Unified Digital Identity

- Portable Reputation Systems

- Cross-Chain KYC and AML

- Privacy-Preserving Identity Sharing

- Interoperable Governance Systems

Cross Chain Landscape is not just limited to Asset and Context sharing. It also encompasses the entire Web3 ecosystem. here are other use cases, which are widely used or can be promoted inf future;

- Sharing Game Assets Across Chains

- Cross Chain Gaming/NFT Marketplaces

- Dynamic Chain Selection (a user might choose to keep their long-term savings on a highly secure, albeit slower chain like Bitcoin, while moving some assets to a faster, cheaper chain like Solana for day-to-day transactions or DeFi activities.)

- Improved User Experience

- Cross-Chain IoT Networks

- Multi-Chain Governance for DAOs

With great interoperability comes great responsibility.

Current Cross-Chain Interoperability Challenges

While the potential benefits of cross-chain technology are immense, several significant challenges must be overcome to realize this potential fully. Understanding these challenges is crucial for developers, users, and investors in the cross-chain space.

Security Challenges

- Bridges often fall pray to hackers. Due their centralization! and most of existing bridges opt for centralization approach because of their ease of bridging. making them no different from CEX

- Replay attacks occur when a valid transaction on one chain is maliciously repeated on another chain.

- In an eclipse attack, an attacker isolates a node from the rest of the network, feeding it false information.

- Different blockchains often use vastly different cryptographic primitives, consensus mechanisms, and execution environments. This heterogeneity presents significant challenges for cross-chain interoperability.

- And Lot more Security vulnerabilites account for Huge number of attacks and funds lost.

User Experience And Lack of Standardization

For cross-chain technology to achieve widespread adoption, it must offer a user-friendly experience that is accessible to everyone, not just blockchain experts. Current solutions often present complex interfaces, requiring users to manage multiple wallets and understand the intricacies of different blockchain networks. This complexity can deter users. Additionally, variations in block times and finality guarantees among different blockchains can lead to confusion and frustration when performing cross-chain transactions. Implementing robust error handling and recovery mechanisms for potential issues like transactions getting stuck between chains is crucial but challenging.

The lack of standardized approaches to cross-chain interoperability is a significant obstacle. With multiple solutions like atomic swaps, wrapped tokens, and bridging protocols, ensuring compatibility between different approaches can be complex. As more cross-chain solutions emerge, the challenge of achieving interoperability between these solutions themselves becomes increasingly important. A truly interconnected blockchain ecosystem may require not only cross-chain solutions but also interoperability among these solutions.

"And here we introduce ODIN of Cross Chain Xythum Bridge."

Xythum Cross: Revolutionizing Cross-Chain Technology

How Cross-Chain Interoperability is Typically Achieved

Before diving into Xythum’s unique approach, let’s briefly review some of the common methods used to achieve cross-chain interoperability:

Atomic Swaps: These are peer-to-peer exchanges of cryptocurrencies from different chains, executed in a way that either both parties receive their funds or neither do. Atomic swaps eliminate the need for trusted intermediaries but can be slow and complex for the average user.

SPV (Simplified Payment Verification) Clients: These light clients allow one blockchain to verify transactions on another blockchain without downloading the entire chain. SPV clients enable more efficient cross-chain communication but have limitations in terms of the types of verifications they can perform.

Relay Chains: These are separate blockchain networks designed to facilitate communication between other blockchains. Relay chains can be effective but introduce additional complexity and potential points of failure.

Bridging: This involves locking assets on one chain and minting representative tokens on another chain. Bridges can be centralized or decentralized and are a popular method for enabling cross-chain asset transfers.

Each of these methods has its strengths and weaknesses, and many cross-chain solutions use a combination of these techniques. However, they often struggle to balance security, decentralization, and user experience effectively.

Xythum takes a innovative approach to cross-chain interoperability, combining several advanced technologies to create a solution that is secure, decentralized, and user-friendly. Let’s explore the key features of Xythum:

1. Hybrid Atomic Swap and Market Maker System

- For high-demand token transfers, Xythum relies on atomic swaps facilitated by a network of market makers. This approach ensures that popular trading pairs have high liquidity and fast execution times.

- The use of atomic swaps maintains the trustless nature of the exchanges, eliminating counterparty risk.

- Market makers are incentivized to provide liquidity, ensuring a smooth user experience even during periods of high demand.

2. Dark Pool-Based Bridge with Zero-Knowledge Proofs

Unlike traditional bridges where all orders are visible, Xythum’s dark pool approach means that order information is kept private until execution. This is achieved through the use of zero-knowledge (ZK) technology, which allows for the verification of transactions without revealing their contents.The dark pool approach provides several benefits:

- Enhanced privacy for users, as their trading intentions are not visible to the broader market.

- Reduced front-running and other forms of market manipulation.

- Improved execution for large orders, as they can be filled without causing significant market impact.

3. Decentralized Bridging with Aggregated Signatures

Xythum employs a decentralized bridging mechanism that uses aggregated signatures, This approach distributes the responsibility of validating cross-chain transactions across multiple nodes, Aggregated signatures allow for the combination of multiple signatures into a single, compact signature Which results in eliminates single points of failure, Faster transaction processing, less Tx Size causing Cheap txs.

4. AI-Powered User Experience

Recognizing that user experience is crucial for the adoption of cross-chain technology, Xythum integrates advanced AI capabilities:

- Real-time AI assistance guides users through their cross-chain journey, making complex operations accessible to novice users.

- The AI has comprehensive knowledge of all supported blockchains, including their features, current status, and relevant statistics.

- Advanced features enabled by the AI include:

- Natural language processing for placing limit orders and executing swaps.

- Predictive analytics to suggest optimal trading strategies based on market conditions across multiple chains.

- Automated gas price optimization to ensure transactions are processed efficiently across different chains.

5. Simplified Payment Verification (SPV) Integration

Xythum incorporates SPV technology to enable efficient verification of transactions across chains, SPV allows Xythum to confirm transactions on one chain from another without the need to download and process entire blockchains.This is particularly useful in conjunction with the dark pool system, allowing for efficient verification of trade execution without compromising privacy.

Xythum is checkmate for Briding centralization!! Well we offer fast and cheap order through techniques such as sharding, Taproot transactions for Bitcoin, Adapting to schnoor singature for less computation on all chains, Order on xythum execute asynchronously hence we offer multi processing/ batch processing reaching new limits. Xythum highest priyority is user and their privacy offering advanced security to their funds and privacy to their order execution.

In conclusion, cross-chain technology is not just a nice-to-have feature in the blockchain space – it’s an essential component for realizing the full potential of Web3 and DeFi. With innovative solutions like Xythum Cross leading the way, we’re moving closer to a future where blockchain interoperability is the norm, not the exception, unlocking new possibilities for financial innovation and user empowerment.